Our investment team conducts in-depth market research, identifies promising opportunities, and makes strategic decisions to enhance asset growth.

Market Pulse: June 9 – June 13, 2025 Asian markets kicked off the week of June 9, 2025, on a positive note, buoyed by optimism surrounding Sino-U.S. trade talks and anticipation for key Chinese economic data. Regional markets drew strength from a robust Wall Street performance, which neared record highs following strong U.S. nonfarm payrolls data, signaling economic resilience. Investors were particularly focused on the potential de-escalation of U.S.-China trade tensions after both nations agreed to temporary tariff reductions in May. However, gains were tempered by caution, as markets awaited concrete outcomes from the ongoing negotiations and scrutinized China’s manufacturing and export figures, which have shown strain from prior tariff pressures.

Looking ahead to the rest of the week, market sentiment is likely to hinge on developments in U.S.-China trade discussions and incoming economic indicators. Investors are holding out for a more permanent trade deal, with recent data underscoring the toll of tariffs on China’s manufacturing sector. Meanwhile, broader Asian markets may remain rangebound, with Japan’s performance potentially bolstered by expectations of sustained low interest rates from the Bank of Japan amid weak consumer spending. Global cues, including U.S. inflation data and Federal Reserve commentary, will also play a critical role in shaping market direction, as traders assess the balance between economic growth and inflationary risks stemming from trade policies.

09/06/2025

Our model portfolio performed well since its implementation in January 2023.

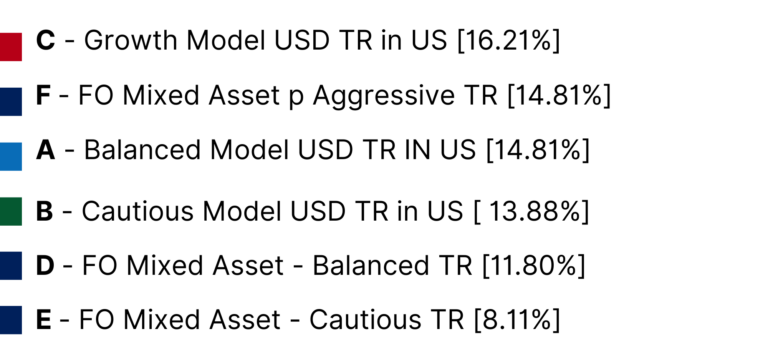

Our model portfolios outperformed their benchmarks (FO Mixed Assets):

Astra Growth Model Portfolio (C – 16.21%) vs. ‘Aggressive’ Benchmark (F – 14.81%)

Astra Balanced Model Portfolio (A – 14.81%) vs. ‘Balanced’ Benchmark (D– 11.80%)

Astra Cautious Model Portfolio (B – 13.88%) vs. ‘Cautious’ Benchmark (E – 8.11%)

Our team uses a mix of cutting-edge technology and proven financial strategies to maximise returns and minimise risk, all while aligning with your specific needs. We analyse market trends, diversify portfolios, and apply risk management techniques to deliver consistent performance. Whether you’re planning for retirement, growing your wealth, or securing your financial future, our tailored solutions ensure your investments are working effectively for you.

Commentary:

Global equities rebounded after the U.S. Court of International Trade struck down the tariffs announced in April.

U.S. and technology stocks led the gains for the month.

U.S. inflation eased, while the Eurozone remained steady. The U.K. saw increase in inflation rates.

Our model portfolios stayed positive over the past year, despite recent volatility.

Money market funds continue to deliver solid yields, though rates dipped slightly across major currencies.

We’ve added a stock monitoring table for clients with a more active approach. Let us know if there are specific stocks you’d like to track.

We’re currently reviewing our model portfolios and will share updates in the coming weeks.

Astra Worldwide company is registered and regulated by the Financial Services Commission in Mauritius, Authorisation No. AU19031893.

AstraAsia Group Ltd. is a representative company of Astra Worldwide (Mauritius) duly registered and fully compliant with the Philippines Securities & Exchange Commission | SEC License #FS202106732A

Suite 403, 4th Floor, The Catalyst Building,Plot 40, Silicon Avenue, Ebene, Mauritius

Message us at